- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

Russia still lacks a transparent scheme for directly exchanging cryptocurrency for rubles and back. P2P transactions, which for a long time remained the main instrument, are increasingly leading to bank card blocks, additional document requests and lengthy freezes of funds. However, this does not mean legal solutions have disappeared or that the only path is seeking an offline exchanger.

An alternative can be found in official channels in countries where cryptocurrency has already achieved legal recognition — for example in Belarus, Kyrgyzstan, partially in Uzbekistan and Georgia. These jurisdictions allow working through banks, brokers and licensed exchange services, making the process safer.

When dealing with foreign services, it’s important to use a browser such as MoreLogin, which helps protect personal data, manage multiple accounts and minimize the risk of blocks when performing crypto operations. In this article we’ll examine which options are available today for users wishing to convert cryptocurrency to rubles and back, what fees they’ll pay and how close the exchange rate will be to the market one.

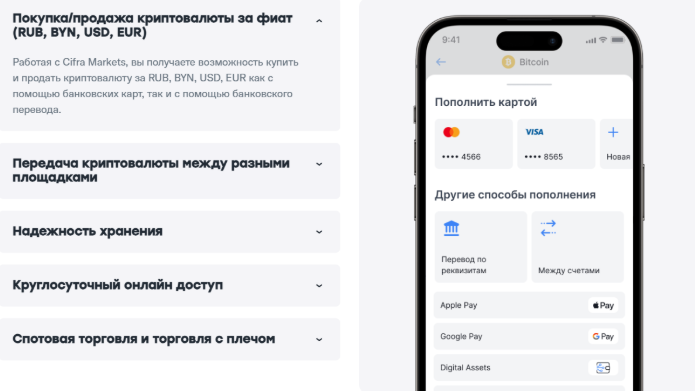

Cifra Markets is a crypto broker from Belarus operating via the IMEX platform and belonging to the Russian holding “Cifra”. Its key advantage is that ruble withdrawals are handled as transfers of one’s own funds, which reduces the risk of bank blocks and additional checks by Russian banks. Through this broker you can convert USDT to rubles and trade a broad spectrum of cryptocurrencies, making the platform a full alternative to classic exchanges.

Fees are fairly transparent: free crypto deposits, 0.25% trading fee on crypto pairs, 1.1% for crypto‑to‑fiat exchanges. A fixed commission of 500 RUB is charged for ruble withdrawals.

Cons: Withdrawal requests are processed in 24 hours, especially noticeable on weekends. Also, Cifra Markets does not have its own app — access to the account is only via third‑party broker platforms of the holding, for example Freedom Broker.

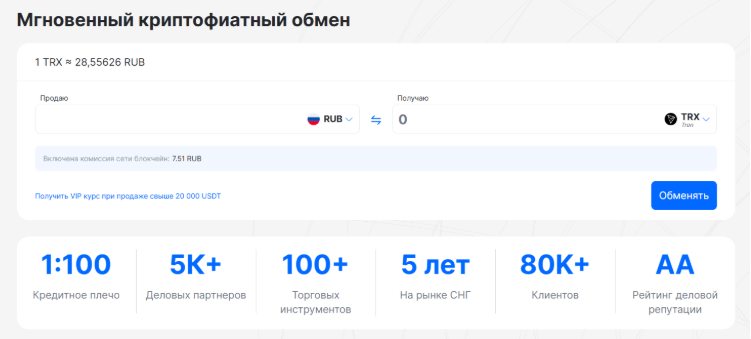

Whitebird is a Belarusian platform licensed for over‑the‑counter crypto exchange, officially registered in the High Technology Park (HTP). The service operates within the legal field, publishes all necessary legal documentation on its site and allows users from Russia to buy and sell cryptocurrency legally, without P2P and “grey” schemes. For Russian citizens this is one of the simplest and safest tools to convert rubles into digital assets and back.

Strengths: Very fast operations (on average 5–10 minutes), large currency selection (USDT, USDC, BTC, ETH, TRON, TON, WBP) and flexibility with fiat: you can exchange to Russian and Belarusian rubles, dollars and euros. Deposits are instant, and crypto withdrawals are available via Tron and TON, which helps reduce fees. In addition, the service issues crypto cards (MasterCard) from Belarusian banks usable outside Russia. A plus for Russians: ability to sell USDT to MIR‑cards of any bank, making Whitebird more convenient for small/medium amounts than competitors (e.g., A7A5).

Cons: Deposit fee can reach 2.17%, and the rate may differ from the official one (for example, 83.8 RUB per USDT when the central bank rate is ~80 RUB — when buying; selling conditions are more favourable). Currently deposits are only available via SberPay. Verification of users sometimes takes longer than claimed, and may stretch up to ~15 hours. Optimally suited for small and medium transactions where speed and transparency are priority, rather than the lowest price.

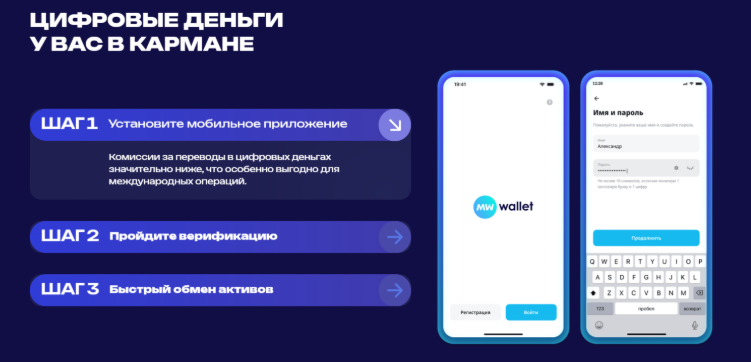

MW Wallet is an Uzbek service that links Russian MTS Bank and Belarusian crypto‑exchange FREE2EX. In both jurisdictions cryptocurrency is officially permitted and regulated — so the scheme is formally legal. The app is presented as an informational service, but in practice operates as a mediator between an MTS Bank card and the exchange.

Advantage: Legal ability to buy and sell cryptocurrency with Russian cards without using P2P platforms. Verification is minimal: you only need to specify the phone number linked to the MTS Bank card. Deposits go through without separate fee, but margin is included in the rate: for example, USDT cost ~83.5 RUB while the official rate was about 80.

Limitations: The service works only with MTS Bank cards. Fee for crypto withdrawal is high: 10 USDT even via TRC‑20 network (where normally <1 USDT). Limits are also not convenient — up to 100 000 RUB per transaction and up to 1 million RUB per month without documents (for Private clients — up to 2 million). Many users prefer to use FREE2EX directly, which offers more flexibility and trust. So MW Wallet looks like a temporary interim solution rather than a full‑scale service.

Cashinout is a licensed Georgian service that enables bypassing the ban on direct crypto‑payments in Russia. The working mechanism is built as a “bridge”: the user transfers cryptocurrency to the company wallet, and partners in Russia make payment in rubles via SBP (QR‑code). This model formally complies with legislation, since crypto is not transferred directly to the seller. At the same time the service requires KYC verification but remains opaque in terms of who exactly is performing ruble settlements inside Russia. For this reason, using Cashinout for storing large sums is not recommended — it's rather a tool for quick payments. Rate difference compared with the Central Bank can reach ~1 RUB.

Pros: speed and convenience. QR‑code payment takes 5–10 seconds, allowing usage even in retail stores like “Pyaterochka”. Supported top‑ups in seven cryptocurrencies (including USDT in TRC‑20, BEP‑20 and ERC‑20). Additional functions: crypto purchase/sale, issuance of virtual foreign cards and payment of overseas services. Unlike P2P deals, here there is no risk of card block under laws 115/161‑FZ, lengthy holds or fraud — funds go directly from a legal entity.

Cons: opaque structure and lack of public information about the team. Also there is a limit per payment of 20 000 RUB, making it inconvenient for large amounts. Security concerns: dependence on custodial wallet and vulnerability via Telegram account used for interaction. The fee for a transaction is 2%.

Each of the available methods of exchanging cryptocurrency has its questionable aspects, but compared with classic P2P, Cashinout eliminates the risk of blocks and the need to explain things to your bank. Therefore, despite limitations, alternative options do in fact exist — and that’s a plus.